Ladder Life Insurance 2022 Reviews, Reddit, Quotes & Coverage

Ladder Life offers a completely digital interface Haven Life Insurance 2022 Reviews, Reddit, Quotes & Coverage for purchasing and managing your Ladder Life insurance policy and has term policies with up to $8 million in coverage. The term life policy is fairly streamlined, without optional riders or perks. If you’re looking to obtain easy, quick and affordable term coverage you can get entirely online, Ladder Life may be worth considering. Ladder Life Insurance 2022 Reviews, Reddit, Quotes & Coverage

Life insurance plays an important role in your financial plan. While personal finances seem to evolve every year, the life insurance industry has been largely stagnant. Ladder Life Insurance is changing that by bringing innovation to an archaic life insurance industry. The company was founded in 2015 and currently offers term life insurance nationwide through a 100% online interface.

This enables prospective insureds to complete everything from comparing or obtaining a life insurance quote to filling out an application and obtaining coverage conveniently. Eligibility requirements indicate that applicants must be between 20 and 60 years old, but a medical exam is not required for those who apply for $3 million or less in coverage.

Weigh the pros and cons of this Ladder Life insurance review if you are considering purchasing term life insurance on this digital platform.

Ladder Life Insurance Review

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here’s how we make money.

Ladder Life Insurance Reddit

In the process of purchasing more life insurance. I need to decide the benefit amount and term that would make the most sense.

Quick personal finance overview:

Age: 36

Salary: $160k (will increase to $250k in 10-15 years)

Debt

Mortgage: $180k (24yrs remaining)

Auto: 18K (3.5yrs remaining)

Retirement

Current total: $80k (contribute 27%)

Have 2 children, 4 and 1, that I will be starting college funds for shortly.

I was given quotes for 6 policies.

I was considering laddering two policies: $1M/20 yrs@$38/mth and $1M/30yrs@$71/mth

I was also quoted $2M/25yrs@110/mth (this seems like too much coverage after 20 years)

Should I consider this combination: $1M/20yrs; $500k/25 yrs; $500k/30yrs

If things go as planned, I think I’d be mostly self insured after 20 years and would maybe just need something to cover unforseen debts or to delay my wife from needing to withdrawal from my retirement.

Price

Since Ladder only offers term life insurance coverage, it’s generally more affordable than purchasing the same level of whole or universal life coverage.

Third-Party Ratings

Ladder life insurance policies are issued by two different companies: Allianz Life Insurance Company of New York (for New York policies) and Allianz Life Insurance Company of North America for all other states and Washington, D.C. Some policies are also issued by Fidelity Security Life Insurance Company.

Ladder Life Insurance Companies Worth Investigating :

Bestow : Another digital life, Bestow offers up to $1.5 million in term life insurance without a medical exam.

Ethos : Ethos uses algorithmic underwriting to offer many instant life insurance approvals for term or whole life through five highly-rated life insurance companies.

Lemonade : Customers can apply for up to $1.5 million in term life insurance through a 100% digital platform, with leftover company profits donated annually to a charity of your choice.

Ladder Life Insurance Quotes

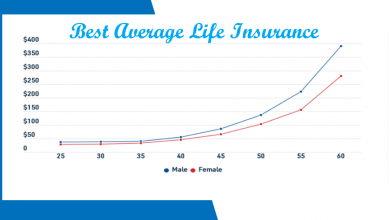

For smaller life insurance policies, Ladder’s rates are similar to those you’d find from other online insurers, but they are not the cheapest available in the market.

# Ladder Life Insurance 2022 Reviews, Reddit, Quotes & Coverage