Ethos Life Insurance 2024 Review, Reddit, Quotes & Coverage

Launched in 2016, Ethos offers term and whole-life policies online. Ethos says completing the online application can take as little as 10 minutes and that most people who qualify for coverage don’t need a medical exam. Coverage amounts range from $1,000 to $1.5 million. Ethos calcifies eligibility using data such as your motor vehicle records, family medical history, and current drug prescriptions. ” Ethos Life Insurance 2024 Review, Reddit, Quotes & Coverage. “

Ethos Life Insurance 2024 Review

Ethos offers no-exam term life and whole life insurance policies through its online marketplace, focusing on a quick and convenient approval process. Its no-exam term life insurance rates are competitive. Ethos life insurance is worth considering if you’re looking for an easy online application process. But if you’re under age 66, you’ll have to look elsewhere for whole life insurance.

Ethos Life Insurance Reddit

About The Ethos Life Insurance Company

On the Ethos website, you can get a quote, estimate how much life insurance you need and learn more about the company’s policies. If you’re qualified, you may be able to start coverage immediately. Ethos doesn’t currently sell any other types of insurance besides term and Ethos Life Insurance 2022 Review.

Customer Service

Ethos has multiple customer service options. You can reach customer support via email, phone, or text. Ethos Life Insurance 2022 Review, Reddit, Quotes & Coverage.

- Phone: 415-322-2037

- Text: 415-702-1844

- Email: Support@ethoslife.com

Ethos’ team is available Monday through Friday from 8 a.m. until 6 p.m. CST.

Ethos Customer Complaints

Over three years, Ethos has drawn fewer complaints to state regulators than expected for a company of its size, according to a Nerd Wallet analysis of data from the National Association of Insurance Commissioners.

Ethos Life Insurance policies

Ethos offers standard term life insurance to people ages 20 to 65 in all states except New York. Policies are issued through Banner Life Insurance, Ameritas Life Insurance or TruStage. Available terms are 10, 15, 20 and 30 years. The application process is 100% online. Life insurance agents can answer questions by phone, text or email.

Some policies include accelerated death benefits, which allow you to take part of the life insurance payout while you’re still alive if you’re diagnosed with a terminal illness.

Ethos may require you to take a life insurance medical exam if it needs more information about your health to calculate eligibility and rates.

The company also sells guaranteed issue whole life insurance to people between 66 and 85 years old. Applicants are approved instantly regardless of health history, and coverage amounts range from $1,000 to $30,000. It’s available in all states and Washington, D.C., except New York. Policies are offered through AAA Life or Trust Age.

Third-Party Ratings

The companies that underwrite Ethos’ policies are major insurance companies with solid reputations. AM Best, the credit rating agency focusing on the insurance industry, issued each company behind Ethos an A (Excellent) rating or higher. A high rating from AM Best says that the insurance companies are sound and financially able to pay their policy obligations and claims.

These are the AM Best Financial Strength Ratings for each of the companies that issue Ethos policies:

- AAA Life Insurance Company: A (Excellent)3

- Ameritas Life Insurance Corp.: A (Excellent)4

- Legal & General America: A (Excellent)5

- Tru Stage Insurance Agency: A (Excellent)6

None of these insurance companies are included in the J.D. Power 2021 U.S. Life Insurance Study. The study ranked 21 insurance companies based on customer satisfaction, pricing, and product offerings.7

Cancellation Policy

- Most insurance companies offer 10-day free look periods. You can review your policy during the free look period and cancel for a full refund.

2. Ethos offers customers more time than most. Ethos has a 30-day money-back guarantee for its policies. If you decide to cancel your policy within the first 30 days of its issuance, you’ll get a full refund. There is no cancellation fee if you choose to cancel after 30 days.

3. Current policyholders can cancel by calling 415-855-4331.

Price

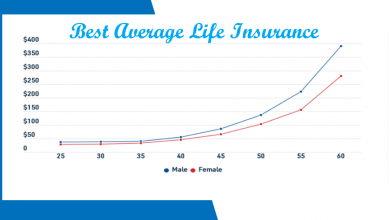

- In terms of price, Ethos’ policies are in line with industry averages for its premiums.

- We got quotes for term life policies for a 30-year-old woman in excellent health to compare rates. When you get an initial quote from Ethos, the company will provide you with a range. You’ll get a finalized rate quote once you answer some more questions.

- Each quote assumes $250,000 in coverage.

# Ethos Life Insurance 2022 Review